Introduction: The Unfolding Debate on Kent’s Council Tax

Kent County Council (KCC) is at the centre of a heated discussion over whether to raise council tax by up to 5%. Reports indicate this increase could be proposed as budgeting talks approach, sparking concern among Kent residents who will directly face any changes. The council tax is a vital source of funding for local services such as adult social care, education, road maintenance and children’s services. This debate holds major significance for homeowners, businesses and community groups across the county.

Conflicting Voices: KCC Leadership on the Potential Rise

Leader’s Position: Decision Still Pending, Speculation Premature

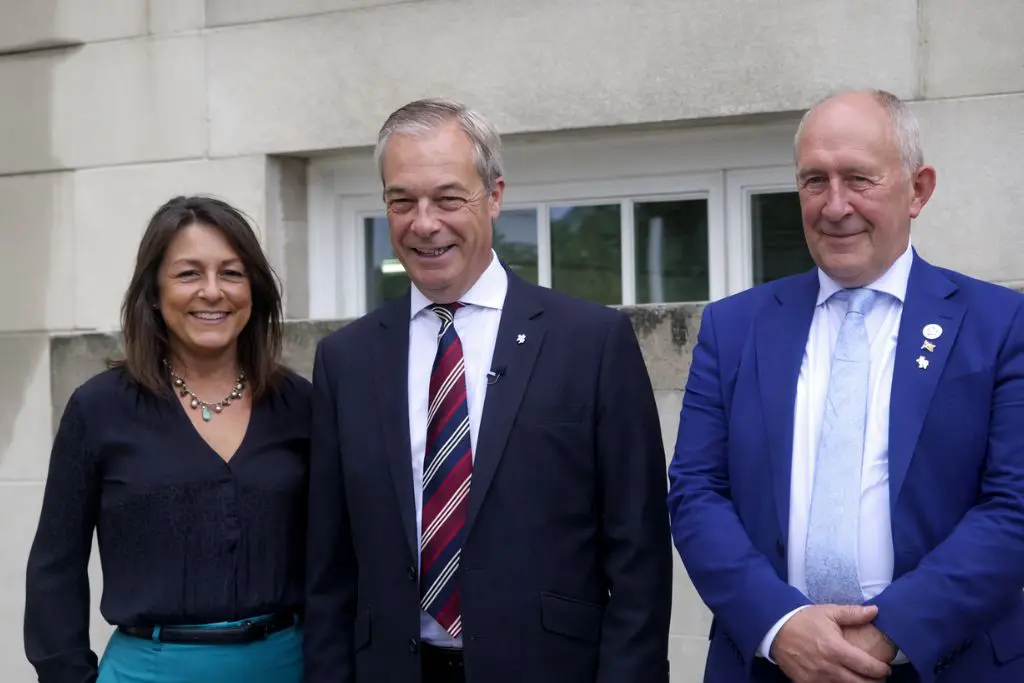

Linden Kemkaran, leader of Kent County Council and Reform UK representative, has stated that no decision has yet been made regarding any council tax increase. He indicated that discussions and official announcements are likely months away, with any final decision expected around November at the earliest. Reform UK’s local election pledges included promises of limiting tax rises, keeping hikes modest if necessary, and focusing on improved governance rather than imposing sudden large increases.

Cabinet Member’s Warning: Services “Down to the Bare Bones”

Diane Morton, KCC’s Cabinet Member for Adult Social Care, has described local services as operating “down to the bare bones.” She highlighted the growing demand and financial strain particularly in adult social care, a service area under national pressure due to an ageing population and increasing care needs. Morton stressed that without additional funding, some services could face serious cuts or reduced quality, making council tax decisions critical for sustaining support for vulnerable residents.

Political Reactions and Calls for Clarity

Opposition Critiques: “Crazy” to Delay, “Huge Betrayal” for Residents

Opposition figures have voiced frustration about the uncertainty and timing of discussions. Liberal Democrat leader Anthony Hook argued it was “crazy” to postpone debate on the tax rise as residents await clarity to plan their finances. Labour MP for East Thanet, Polly Billington, condemned the prospect of a 5% increase as a “huge betrayal” for her constituents already facing economic challenges. Both have called for transparent communication and urgent action from KCC leadership to address budget concerns and community impact.

KCC’s Strategy: Seeking Efficiency and Debt Reduction

Reform UK’s Approach: ‘Doge’ Team Drives Savings

The council’s strategy under Reform UK’s leadership focuses on efficiency to ease financial pressure and possibly avoid steep tax rises. Central to this is the Department of Government Efficiency, known as the ‘Doge’ team, tasked with finding savings across KCC operations. Notable savings reported include approximately £2.5 million from optimising homes-to-school transport routes and plans to reduce long-term debt by £50 million. These measures aim to improve financial stability while minimising direct impacts on residents’ wallets.

The Impact of “Bare Bones” Services on Kent Communities

Services currently described as “down to the bare bones” extend beyond adult social care. Road maintenance budgets have tightened, leading to delayed repairs and pothole fixes. Library services face reduced hours and fewer community programs. Youth services operate with limited staff and funding, potentially reducing recreational and support opportunities for young people. Environmental initiatives also struggle to secure funding, impacting local parks and green spaces. These constraints showcase the tangible consequences of ongoing financial shortages.

Understanding Council Tax: Mechanics and Precedents

Review of Past Increases and Legal Thresholds

In April, Kent County Council implemented a 4.99% increase in council tax under the previous Conservative administration. This percentage represents the maximum rise allowed without triggering a local referendum, where residents would vote directly on any proposed hike above this threshold. If KCC seeks to go beyond 4.99%, it must secure political and public approval through this formal process. This legal framework shapes the council’s approach to balancing revenue needs against public consent.

Broader Financial Context: Expert Insights on Local Government

Jonathan Werran from the Localis think tank notes that many large county and unitary councils are likely to hit or approach the maximum allowed council tax increases each year. The rising cost pressures of social care responsibilities and inflationary challenges put councils in tight positions. Nationally, local governments face reduced central funding and increased service demand, a situation mirrored in Kent. These combined factors create complex fiscal balancing acts that shape decisions on council tax and spending.

What This Means for Kent Residents: Anticipating the Decision

The question residents face is clear: Will council tax rise significantly this year, and how will this impact services? Currently, a 5% increase is not confirmed but remains under consideration. The council’s emphasis on efficiency offers some hope to limit rises, but growing financial pressures and service demands may necessitate additional funds.

Residents should expect a formal decision from KCC by November, following budget finalisations and consultations. To stay informed, local taxpayers can follow updates on kentlocal.co.uk and KCC’s official channels. Engagement and feedback will continue to be important as the council balances financial responsibility with the need to maintain essential services.

Transparent financial management and clear communication remain vital as Kent navigates these challenges. The coming months will be critical in shaping both the council’s budget and the experience of those who call Kent home.