A Landmark Financial Achievement for Kent

Repaying the Past, Investing in the Future

Kent County Council (KCC) has successfully repaid £50 million of its long-term debt early, resulting in significant financial savings for the people of Kent. The repayment included an immediate £5.5 million discount on the principal, along with annual interest savings of approximately £670,000. Over a 40-year period, this totals nearly £19.5 million in savings.

This debt repayment comes against the backdrop of KCC managing a total debt exceeding £700 million, with annual interest expenses around £32 million. By reducing debt levels, KCC lessens the financial pressures on the council and, in turn, on Kent taxpayers.

The direct consequence of this repayment is that KCC can allocate more funds to vital public services without imposing additional tax burdens on residents. This move is not only financially responsible but also reflects a commitment to prioritising community wellbeing now and in the future.

The Strategy Behind the Savings: A Deeper Look

From Debt to Delivery: KCC’s Fiscal Responsibility

KCC’s early debt repayment was a deliberate and forward-thinking decision. By opting to repay debt earlier than scheduled, the council achieved both a substantial discount on the outstanding amount and reduced ongoing interest payments. This required engaging in detailed negotiations with Barclays Bank, the financial institution involved, to secure favourable terms.

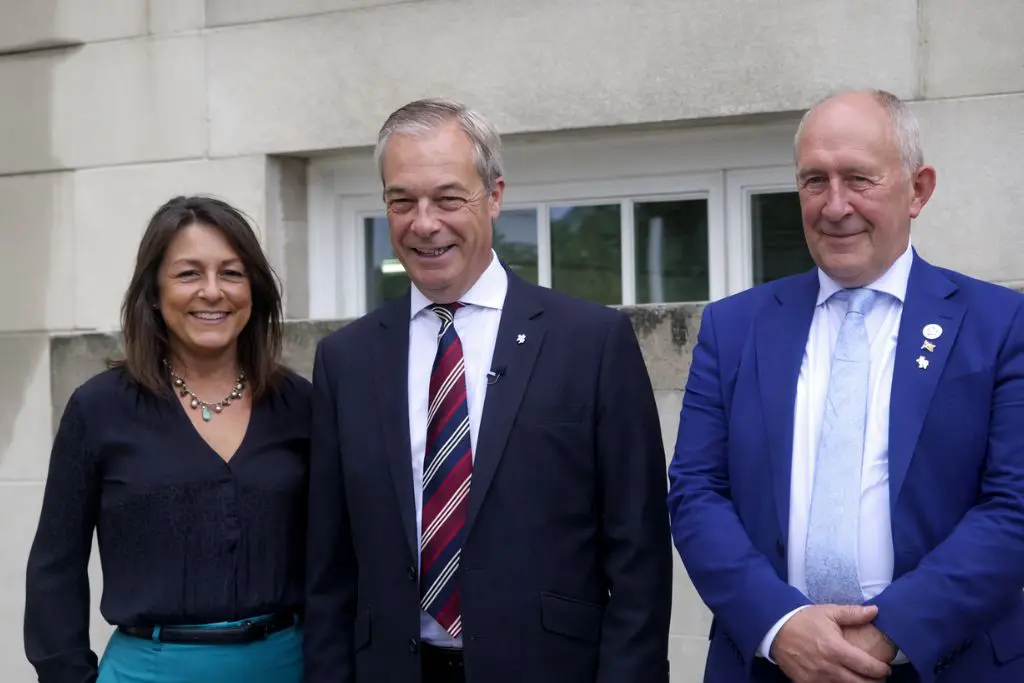

Deputy Leader Brian Collins described the move as “brave and significant,” highlighting KCC’s determination to challenge traditional practices in local government finance. According to Collins, this repayment exemplifies the council’s commitment to sound financial decisions that protect taxpayers and enable better service delivery.

The Role of the Local Government Efficiency Team (DOLGE)

This team forms the backbone of KCC’s financial reform strategy, ensuring that spending aligns with strategic priorities and that the council maintains long-term fiscal health.

Impact on Kent: Strengthening Frontline Services

Releasing Funds for What Matters Most

The savings from the debt repayment will be reinvested into frontline services that directly affect Kent residents. This includes improved social care provision, allowing more vulnerable individuals access to essential support. Additional funding will also bolster children’s services, aiming to provide better outcomes and opportunities for young people across the county.

Road maintenance and highways will benefit from increased investment, leading to safer and more reliable transport infrastructure. Education facilities will likewise see enhancements, supporting staff and pupils with improved resources and environments.

By reducing interest payments, KCC frees operational funds that were previously locked into servicing debt, allowing for more responsive and impactful public services.

Long-Term Benefits for Taxpayers

Combined, the initial lump sum saving and the ongoing interest reductions contribute to a sustainable financial future for KCC. These savings help mitigate upward pressure on council tax rates and create room for further investment in community priorities.

Kent residents can expect a council that manages its finances prudently while striving to meet local needs effectively.

Navigating the Broader Financial Landscape

Kent’s Unique Challenges and National Pressures

Kent faces distinct financial challenges as the United Kingdom’s primary gateway to Europe. This position exposes local services to heavier demands, including infrastructure stress and increased social service needs. Such factors add complexity to KCC’s budgeting and service delivery efforts.

Across the country, local authorities are grappling with budget constraints and funding shortfalls. KCC, understanding Kent’s particular situation, actively engages with the Government to secure fair funding arrangements that reflect the county’s pressures.

A Vision for Sustainable Growth and Services

This debt repayment aligns with KCC’s new draft Strategic Statement, which emphasises reducing the overall debt burden and ensuring efficient spending. The council’s administration prioritises a pragmatic and measured approach that controls costs while supporting essential services.

By maintaining a clear focus on financial discipline and long-term planning, KCC aims to provide Kent residents with reliable, high-quality public services now and in the future.

Have Your Say: Engaging with Kent’s Financial Future

Get Involved in the Budget Consultation

KCC invites all residents to participate in the upcoming Budget Consultation for the 2026-27 financial year. Public input is valuable in shaping the council’s priorities and ensuring that investments reflect the community’s needs.

Participation is encouraged through the official consultation website, where residents can view proposals and submit their views. This is an opportunity to contribute constructively to Kent’s financial planning and service improvement.

More information and consultation access can be found on KCC’s website or by contacting your local council representative.

Kent County Council’s decisive action in cutting £50 million from its debt illustrates its commitment to fiscal responsibility and community wellbeing. Through continued transparency and public engagement, KCC aims to build a financially secure future that benefits all Kent residents.